Fig.co is a crowdfunding website which sounded like a pretty neat idea at the start. After all, for years we’ve been hearing people complain about how Kickstarter isn’t about “investing” in projects. In many ways, the popular site is utilized like a very early pre-ordering option. Fig gives people the chance to legitimately invest in a game they have faith in and (eventually) see a return on that investment when the title launches. Yet, that cool concept alone has not propelled Fig into superstardom. Instead of making a name for itself immediately alongside Kickstarter and Indiegogo, it already appears to have fallen by the wayside as something only niche, extra-obsessed fans of crowdfunding still care about.

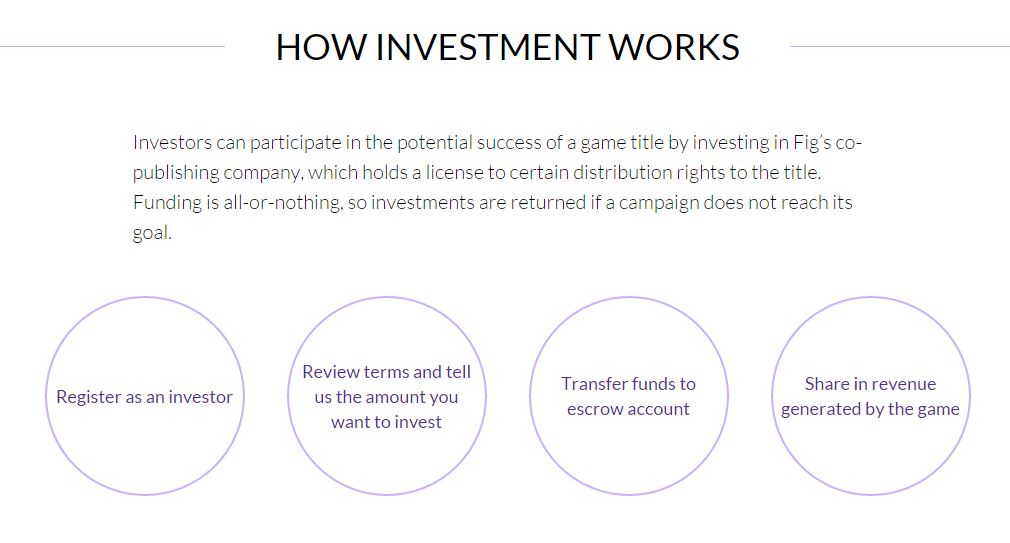

But how did this happen? Weren’t people clamoring for a real shot at getting something back for their monetary contributions in an investment-style fashion? Yes, some folks were, but it appears that the reality does not mesh with the concept many had in mind. Fig.co launched with the ability for accredited investors to drop funds into their projects from an actual investor angle. Anyone who was not an accredited investor could still pledge, but would be deemed a “fan” and only receive the reward tier gift and nothing more. There’s no doubt that there are accredited investors out there looking to break into the game scene, but they may not number in as high amounts as Fig expected. Or, perhaps investors, once scorned, move elsewhere.

By the end of their inaugural campaign, Outer Wilds, Fig had received $75,000 in funding from investors. But that’s not the whole story. You see, they capped the potential funds from investors at that fee (something we’d probably never see if Kickstarter implemented similar measures). With that said, Fig received $925,000 worth of expressed investor interest for the game. All of this money simply was not allowed to funnel into the campaign. In the end, Outer Wilds found itself stuffed full of investor cash but just very slowly crawling toward its $125,000 funding goal. Regular backers had to pick up that $50,000 difference. They did by the end, but just barely, resulting in a project which just skirted by with a 101% funding rate.

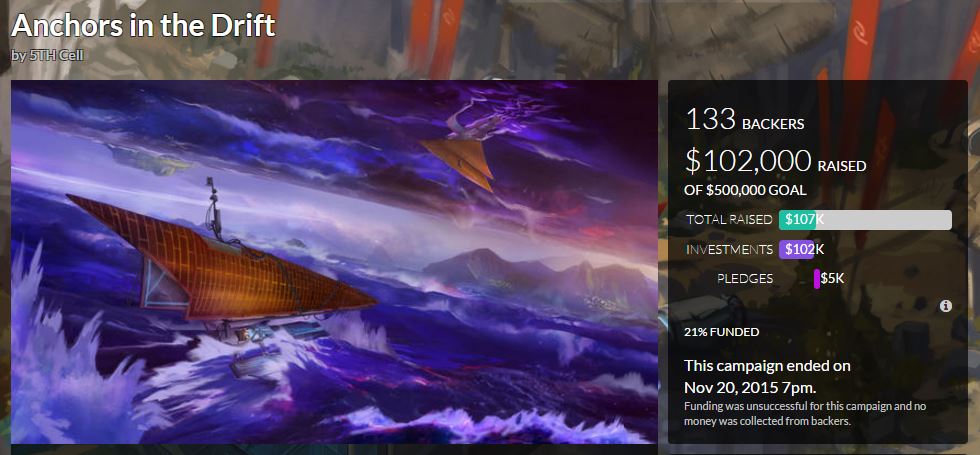

Where did all that immense interest from investors go when Anchors in the Drift launched? I can’t say for sure, but it seems like the excitement surrounding Fig had all but deflated at this point. Unfortunately, I did not take note of the total amount of funding investors were allowed to drop on this project, it appears that they never did reach their cap. $102,000 in funding is a slightly odd place to put a cap in my opinion if that was it, anyway. Also, given the fact that Outer Wilds accepted 60% of backing from investors, it would seem downright odd for Anchors in the Drift to force just 20% of its funding from investment. Whatever the case may be, there’s no doubt I will be far more vigilant about record keeping with future Fig projects.

One of the most unfortunate — and downright worrisome — aspect of the campaign may have been simply that regular old backers did not show up in force for the campaign. In total, Anchors in the Drift received $5,000 in funding from those folks. This, despite the fact that 5th Cell is a known developer with a fanbase. Where are the everyday backers? Did they decide it wasn’t worth the effort to signup and start using yet another crowdfunding service? That’s definitely possible. Were they simply bored by the idea of this game? Maybe! Is it possible that they actually didn’t realize that Fig was open to them as well as investors? I have a feeling that all three of these possibilities played into why there was not more support from this group for the game.

The last point is something that Fig needs to work on. Their messaging has made its way out there via a variety of big gaming sites. Still, most pitch their stories about Fig in the same way: “Fig’s a new crowdfunding site with actual investment opportunities” or some such tends to be the general focus. Indeed, this is the most noteworthy aspect about Fig. But it may impress upon people the idea that you have to be an investor before you can utilize the site at all. We know that’s not the case, but some may have interpreted these news blurbs in that fashion. Fig may not be doing themselves any better with their latest announcement.

Fig took this week not to acknowledge Anchors in the Drift’s failure but re-announce information that they’ve been saying since the site went live. They will soon allow unaccredited investors to participate in the investing side of things on their platform. What’s newsworthy about this is they revealed that this functionality will be available just in time for the next project on Fig this December. What does this mean exactly? Well, it’s actually not as cool as it sounds (and this is another unfortunate, if inevitable reality for Fig).

Previously, in order to participate in investment on Fig you needed to be an accredited investor, make $200,000 a year or have a net worth of $1 million, and pledge a minimum of $1,000 to the project. Unaccredited investors will not need to meet the first two restrictions. However, they will still need to pledge $1,000 at minimum. These folks are also restricted from investing more than 10% of their annual income or net worth. Meaning, if you invest at the minimum rate as an unaccredited investor then you’ve got to at least have $10,000 in earnings/net worth. Presumably, many of those who avidly crowdfund meet this minimum. Also, the maximum any one unaccredited individual may pledge is $10,000.

The thing is — are people who aren’t “serious” about investing (presumably since they’ve not gone for accredited status) ready to dump $1,000 or more on a crowdfunding project? The allure of receiving dividends on a game once it’s out is neat but is it enough of a lure? Those most into crowdfunding know that it has the potential for greatness but also a tremendous potential for challenges or outright failure. In the best circumstances, games may be completed months and years later than planned. We know this. Are crowdfunding fans willing to wait years to see a meager return on investment? It’s impossible to say, but it seems unlikely for the experienced Kickstarter backers out there.

I mean, honestly, if you look into the potential benefits of backing it’s a really tough situation to make appealing for folks who are only brave enough to drop $1,000 on a campaign. Let’s use Anchors in the Drift’s values for an example (though each developer will be able to set investment numbers accordingly). Presuming a backer invested $1,000 into the game, they would expect to receive 0.02% of the game’s net revenue once it was out and about for sale until recouping their thousand buck investment. After this point, they would receive 0.01% of net revenue. This is all true provided that “the game and company are successful.”

Yes, that’s the other big part of investment: Uncertainty. You cannot be assured that a Fig game will become a big success, or even recoup all its expenses. It’s possible you’ll hop aboard the next Minecraft and have your $1,000 back fast and enjoy 0.01% of extra money for years to come. Or you might never ever get your initial investment back. Folks who have used to investing recognize uncertainty is a fact of life but those of us who have never invested before might not find this prospect nearly as inviting. I mean, heck, I’ve certainly never pledged $1,000 on Kickstarter even for a really sweet reward. Some out there probably will find the allure outweighs its costs, but for many, it’s just no longer appealing to be a crowdfunding investor when faced with the reality of its implementation.

All of this will come to fruition provided the U.S. Securities and Exchange Commission’s review of Fig’s filing actually goes well. As of right now, it’s still under review and likely won’t be approved before the next campaign closes. So what the heck does that actually mean about implementation? According to Fig, they “will take non-binding reservations from unaccredited investors for $1M of shares that are being set aside.” This super hefty amount of shares seems to show that they’re expecting a huge outpouring of unaccredited backer support. If past Fig campaign trends are being followed, it also means the project itself will have a higher than $1 million goal. There’s no word as of yet what happens if the filing falls through and tons of folks do attempt to pledge as investors.

This exemplifies Fig’s issues. They are undoubtedly very excited about the platform they have created and the uniqueness it brings to the crowdfunding table. However, for whatever reason, they seem to be pushing full steam ahead before taking the time to truly analyze what type of audience they have. Things were looking pretty good from the investment side for Outer Wilds, but the same was not true when Anchors in the Drift arrived in October. At that point, non-investor backers seemed to completely dry up, too. Because of the realities of investing, it seems unlikely that fans will arrive in droves to toss $1,000 into the pot. At least, not near the tune of that $1 million cap.

Without investor support, Fig needs more standard backer support. Without regular backer support, they require more investor support. It appears that they hope to achieve the latter by trying to convert backers into investors. Somehow, I do not feel it will work out as they’re hoping. Of course, I’ve been wrong before and could easily be completely of the mark here as well. What are your opinions about Fig? Let us know by sharing them in the comments section!

I think we really can’t stress those low royalties enough: 0.02% of net revenue “less certain deductions and exceptions” for every 1,000 dollars invested! If you extrapolate these numbers, you’re looking at a break-even point of 5 million dollars. Add the aforementioned deductions, retailer (Steam) margins and VAT, and it’s suddenly 10 millions in gross revenues – more if they somehow manage to include marketing expenses (which are huge for a f2p game)! Of course, this only gets you your money back… before taxes.

Where’s the fun in that? Frankly, I’m surprised they found (8, apparently) investors willing to pledge 100K! The next project will have to be amazing, or Fig is done for.

P.S.: I think it’s worth noting that the “Outer Wilds” campaign was in trouble as well. Fig had initially limited investment to 50,000 dollars, but it was clear the campaign would fail if it relied on traditional backers to cover the rest, so they allowed another 25,000 dollars of investment money.

Thanks for dropping by (I figured you might 🙂 )! I agree, these are some very low returns investors are primed to get (if they get anything at all, really). It’s an incredibly weird thing that Fig is doing. On one hand, they want to appeal to actual investors but they are offering such low returns that it seems strange that anyone would really want to when they could, you know, actually invest on the stock market.

In some ways it feels as though they’re trying to appeal to everyday people (which this unaccredited thing theoretically has the potential to do, if not for the fact that you’re still asking people to drop $1000) with the IDEA of “investing” but with a lot less of the potential perks. I think legit investors out there realized that and have moved on once they got over the excitement of “video games!!!”.

Although they’ve not confirmed it, I’m thinking the December campaign will be the next Harmonix game. GIven the performance of their Kickstarter for Amplitude, dunno how this could turn out.

Fig as a crowdfunding platform has a number of issues, but I’ll narrow down just a few of the problems I have with it. My first issue is that Fig needs to allow multiple campaigns to run at once, backers need to have the freedom to choose, otherwise they’d be better off back on Kickstarter or Indiegogo. The second issue is awareness, simply put most people don’t know it exist, and the ones that do clearly aren’t jumping on the band wagon. Third they need to offer better investment incentives, if their going to open the floodgates, as they are currently doing.

P.S. So glad they dropped the investor cap they had before, and are now allowing people with just $1,000 to invest a way in. However as someone else has stated in this comment section the 0.02 investment return is a joke, for that amount you’d be better of keeping the money in the bank, a thousand bucks isn’t cheap loose change in this economy.

Nice points! It’s so true that very few people even know that Fig exists right now. Sure, we know, but we’re more interested in crowdfunding than typical gamers out there.

When they launched I thought the idea of focusing on one campaign at a time was fantastic. However, the projects they have chosen so far seem good but not mind-blowingingly amazing that they “deserve” that much exclusive attention. Maybe I’m wrong? But the challenging of getting both Outer Wilds and Anchors in the Drift funded seems to prove others agree with this.

Yeah, the return rate is actually specified per developer per project, but they will probably all be similarly low… unless they realize that’s not alluring. It’s hard to say what will happen next for sure!

[…] games and get money back in return and that is the very reason I don’t trust it. See Fig has some problems, it’s an example of a nice concept that doesn’t really play out well in reality. While […]

[…] There have also been some critical spotlights aimed at Fig, the investment opportunities and a very thorough breakdown of the differences between accredited and non-accredited investors making use of the service in a detailed article by Cliqist. […]