First, the biggest difference between Fig and the dominant Kickstarter is that Fig is tailored toward video games and video games alone. As far as can be seen, they do specifically mean video games and not other gaming concepts such as tabletop games. This isn’t the first time a site attempted to provide such a niche. GamePledge, for example, tried (and apparently failed, as the site is now gone) to craft a gaming crowdfunding space. Why video games specifically? For one, everyone involved in the project is a game developer. Aside from Bailey, the Advisory Board is full of well-established names such as Aaron Isaken (co-founder of Indie Fund), Brian Fargo (inXile Entertainment), Feargus Urquhart (Obsidian Entertainment), and Tim Schafer (Double Fine Productions). Notice how almost all these folks have also utilized crowdfunding in the past?

Here’s a quote with what appears to be Fig’s complete mission statement to get a better sense of their “why”:

“Together we can grow the games ecosystem, inspire new community-informed, investor-backed titles, and provide a creative platform for studios to bring their ideas to the people who matter the most — their fans.”

The other important aspect of about Fig is that it allows for both rewards-based funding (what Kickstarter and Indiegogo are known for) and investment. Yes, that’s actual investment and not the “perceived investment” that backers sometimes believe they get into with Kickstarter. So, what does that entail? Legitimately investing in a game on Fig allows you to “show your support for the game and share in the net revenue of potential game sales on certain PC platforms.” Of course, more terms and conditions apply, some of which can be read in depth here. Speaking of which, this might sound outrageously cool, but as of right now you do need to be an accredited investor to even take part. Why’s that?

Well, for one, Fig currently requires a minimum investment of $1,000 on a project. Rewards-based backers can of course pay far less, but investment is meant to be a bit more serious here. What does it take to be an accredited investor? You need to have an income exceeding $200,000 or a net worth of over $1 million. Here’s a link to learn more about this topic. So basically, you’re going to need to be pretty darn well off to utilize the investing component of the site. That’s smart considering they are asking a fair chunk of change up front. If they let anyone “invest” then things could go terribly wrong. As the official press release summed up, “investments are only available to accredited investors who understand and can afford the risks of investing in private securities.”

There is one scary aspect about this whole investing feature that needs to be addressed, though. In one press release, it is stated that “Fig plans to make investment financing available to everyone.” That just discounts their previous quote about ensuring folks know what they’re getting into with investing. It’s not a game to put thousands of dollars on the line for most of us crowdfunding fans out there! Of course, some already do via superbly lavish reward tiers. It just seems a bit worrisome when you consider how badly a handful of campaigns have gone over the years. Not only that, but backers have certainly become angry over time when just dealing with not getting rewards. How might the dialogue change (or become far more serious) when business investments are on the line?

I don’t know the answer to that question. It’s worth noting that investment-based crowdfunding has existed on a variety of sites and is quite popular with angel investors. However, sites such as those typically focus on non-video game endeavors. Those seem to work without much issue (though that is my outsider perspective) thanks to a class of investors who know what they’re getting into. There’s no doubt that many crowdfunding fans are quite savvy, but it’s unfair to assume that every single one of them holds themselves to a similar standard. Basically, Fig is a site that we’re going to keep an eye on to see what transpires as they work through their launch campaign and beyond.

Finally, Fig offers something else totally unlike Kickstarter and Indiegogo: Curation. Yes, just check the About Fig page to find the line stating: “Fig is a curated platform for funding and developing games with the direct support of passionate players like you.” The curation is handled by the Advisory Board, meaning prospective developers need to impress some incredibly talented people to get their foot in the door. It also means you should never expect to see a low information campaign on the front page of Fig. This is huge in that it cuts out the clutter which so often permeates the crowdfunding landscape. Of course, that’s not always for the best. Is it possible that an incredibly unique and cool campaign gets denied by Fig? Certainly! They are focused on quality over quantity as “Fig will offer one campaign at a time.” There’s no doubt some awesome projects will need to be rejected alongside poor quality ones.

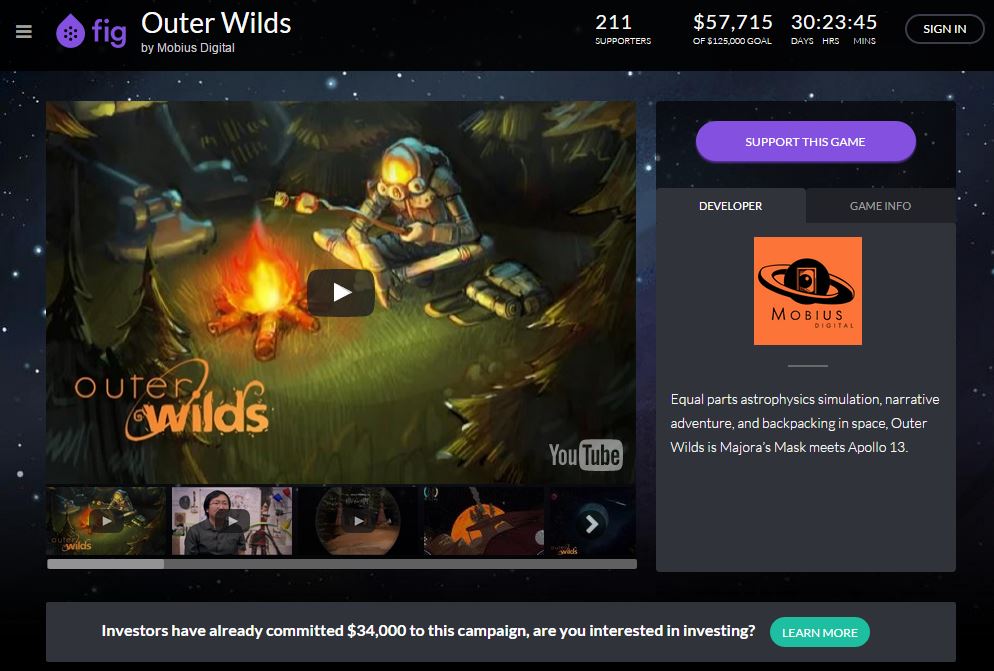

With all this being the case, Fig seems destined to succeed in at least one way. Each campaign it features honestly should succeed. With no competition on the site, and room for investors to thrive, there’s an atmosphere of success just permeating the whole thing. It’s entirely possible some projects will end up flopping, but my assumption is that the early months will do quite well. But really, it depends on how many backers jump on. So far, the majority of the money raised by Outer Wilds is from actual investors instead of general rewards-based funding folks. Without that audience, even a small team of dedicated investors won’t be able to carry each campaign toward its funding goal.

I really like the idea of this, and think that they’ve got some great people on board. However, Thomas Bidaux pointed out to me that they make their money via a 5% cut of the total raised, and 5% of the games sales forever. Could be great for them, but it’s going to take quite a while before games start hitting the market.

Im cool with them taking 5% off of the total raised, however taking 5% off future sales takes away money from investors. If I was investing a minimum of $1000 into a project, I would be furious to know that a third-party entity is taking 5% off the total revenue.

I’m curious to know what type of valuation they give each project. If I back for $1000 what sort of return am I expecting? Is it based on the total raised, or a percentage of what someone says the value of the game is?

Actually, found it:

“For every $1,000 an investor invests in Fig’s production company, if the company and the game are successful, the investor may generally expect to receive:

Until the investor gets their $1,000 back (pre-tax), 0.3% of the company’s net revenue from the PC platforms (as defined in the license agreement);

Until the investor gets another $250 (pre-tax), 0.2% of net revenue;

Thereafter, 0.1% of net revenue.”

I think it’s a cool idea and one that could potentially take off if there’s enough demand for such things. The investment angle is probably their main unique feature. It certainly won’t topple Kickstarter or even IndieGogo but it certainly is a viable alternative. The only issue I have is that it’s only one campaign at a time. While it and the curation will indeed help to weed out the chaff as Marcus said it could also leave some other awesome projects on the wayside.

If I don’t like a project one month I’m not sure why I would go back to the site. I go to Kickstarter to see what new projects there are, and then check up on existing campaigns to see how they’re doing and sometimes back.

I do look forward to the day where us poor folk can take part in investment backing though! It’s going to be a bit of a mess, but also very cool.

And that brings up another problem. If there’s only one a month why bother going back time and again? That’s one thing that I love about Kickstarter and, to a lesser extent, IndieGogo. There always seems to be something running that catches my interest even if I don’t back it.

I’m cool with the $1000 minimum entry fee myself, as anybody investing in a project, should be taking this seriously. However I disagree with the requirement, of investors making $200,000 anually, as that reduces the amount of participants; not to mention prevent people whom might be most invested in the campaign from participating.

I totally agree with you. I don’t like the minimum requirements even if I do understand why they’re there. It should be open to anyone who’s seriously interested in investing their money. And $1000 is already a pretty good hurdle to overcome as it is.

How is Fig supposed to make money with one game at a time? Outer Wilds e.g. has a goal of 125k, so if they make it and Fig take their 5% cut they make 6.25k for a whole month? For a company with at least 8 employees and 4 board members that’s not much, so unless the finished game sells a lot so that they can collect the 5% on sales (which can be years in the future if it ever happens) … am I missing something?

Yeah, I don’t get it either. Why limit it to one project a month? The financial aspect aside, which I totally agree with you about, it doesn’t really instill a need to keep returning to the site. If there’s any real potential problem with Fig it’s that.

Yes, agree with both of you.

Anyway, I’ll keep an eye out for Fig and see how it evolves over time – I wouldn’t mind seeing a strong alternative to Kickstarter, if only to force them to up their game a bit.

I’ve just posted an update on my own old campaign there and found the same bugs and annoyances that KS had nearly 1.5 years ago all still there … they sure can do with some competition 🙂

I’m taking it as a typical dotcom scenario, where they burn through a ton of money for the first couple years until they start getting revenue from the released games. I don’t thinks that’s sustainable, but I’m also not an entrepreneur willing to put everything on the line.

Read the AMA the CEO of fig did

http://www.producthunt.com/live/justin-bailey

I think its supposed to be one high profile and one indie.

Justin Bailey —— — CEO

@corleyh Hi Corley, we’re looking to do two projects a month as our

normal cadence – one large “iii” game and one unknown indie title with a

lot of promise

Justin Bailey —— — CEO

@oliverjudge not really, we’re looking for a mix of indie and well know

titles so the two can build off each other. The main focus is on quality

and the ability to deliver.